How brands have shifted digital spend in 2025

Midway through 2025, it's clear that brands are redirecting their advertising budgets at an unprecedented pace. The move toward digital isn't new, but this year's strategies highlight a deeper recalibration — one defined by AI adoption, measurement precision, and the diminishing relevance of traditional media. These shifts are not just reshaping the marketing world; they're quietly altering how consumers discover, evaluate, and buy products every day, Moonfruit reports.

Key Takeaways:

- Brands are rapidly reallocating ad budgets toward digital channels, driven by AI adoption, precision measurement, and declining reliance on traditional media.

- AI-powered automation, ROI-focused performance marketing, and booming retail media networks are the primary forces reshaping marketing strategies.

- A few major platforms like Google, Meta, TikTok, and Amazon dominate ad spend, pressuring traditional agencies to adapt with faster, data-led solutions.

- Consumers are experiencing more personalized, embedded, and privacy-conscious ads, reflecting broader trends in commerce-driven and automated advertising.

Digital Spend Dominates the Advertising Landscape

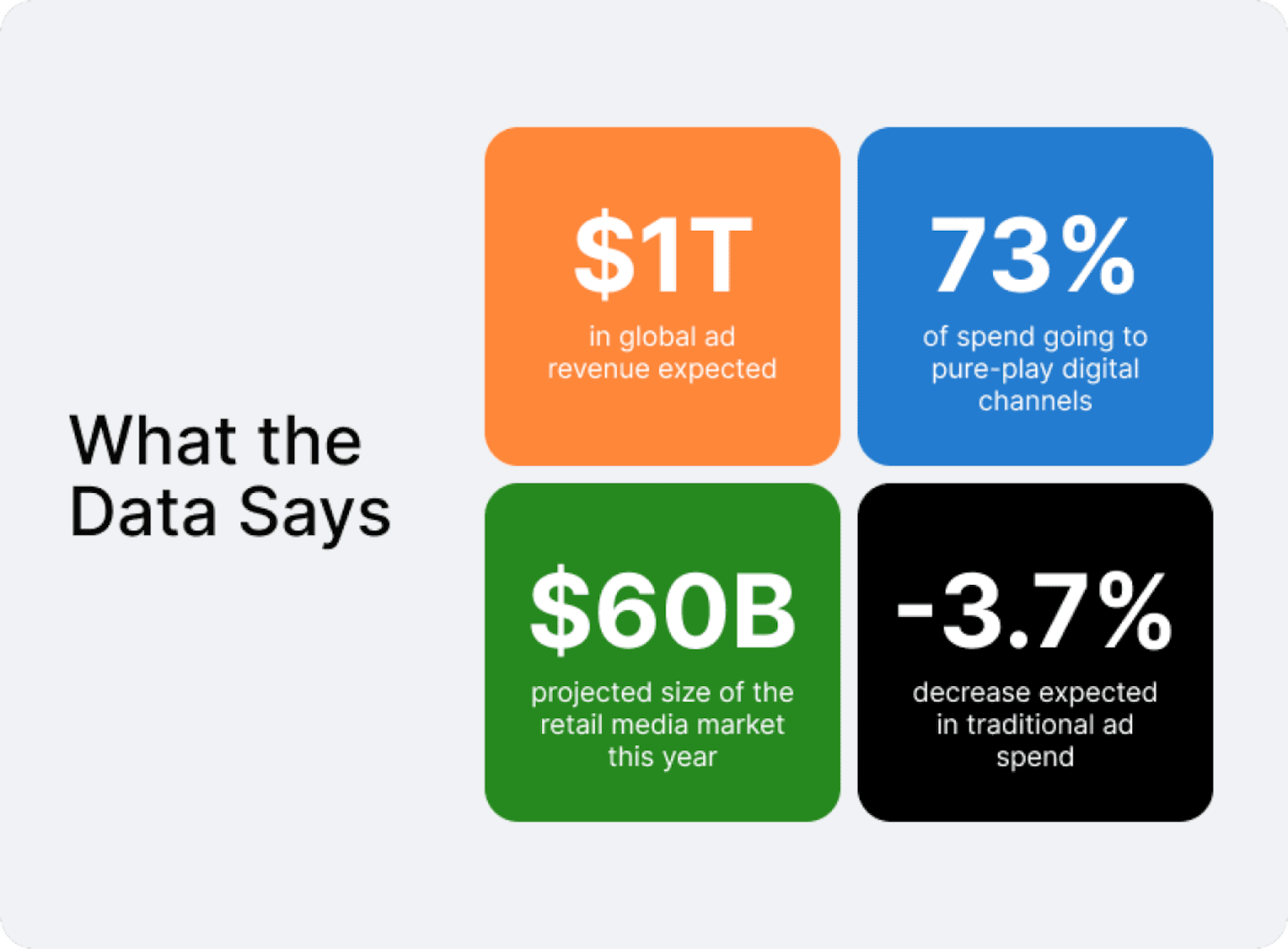

Global ad revenue is poised to surpass $1 trillion this year, with pure-play digital commanding roughly 73% of the total. Traditional media (print, radio, and national TV) is shrinking, as advertisers direct funds toward platforms offering granular tracking, precision, and scale. In fact, from 2024 to 2025, traditional advertising spend is expected to decline by 3.7%.

Moonfruit

Three powerful forces are reshaping ad budgets:

- Rise of AI and Automation. Generative AI tools now power core ad functions — from creative generation to automated bidding — making digital campaigns faster and leaner. Major brands are treating AI as a marketing cornerstone rather than an emerging tech curiosity. Industry leaders, such as the former CMO of General Motors, predict rapid adoption akin to the transition to electric vehicles, underscoring urgency.

- ROI and Efficiency. The days of paying for reach alone are fading. In surveys of brand leaders representing over $66 billion in global ad spend, marketers cited performance-driven media, like paid search, social, and retail, as top priorities. Return on investment now outweighs impressions as the primary metric of success.

- Retail Media Networks. Brands are investing heavily in retail media (ads within e-commerce environments like Amazon, Walmart, and Target), which is estimated to hit $60 billion this year. Growth in retail media reflects evolving buyer behavior and the desire to reach consumers in purchasing moments.

A Closer Look at Budget Reallocation

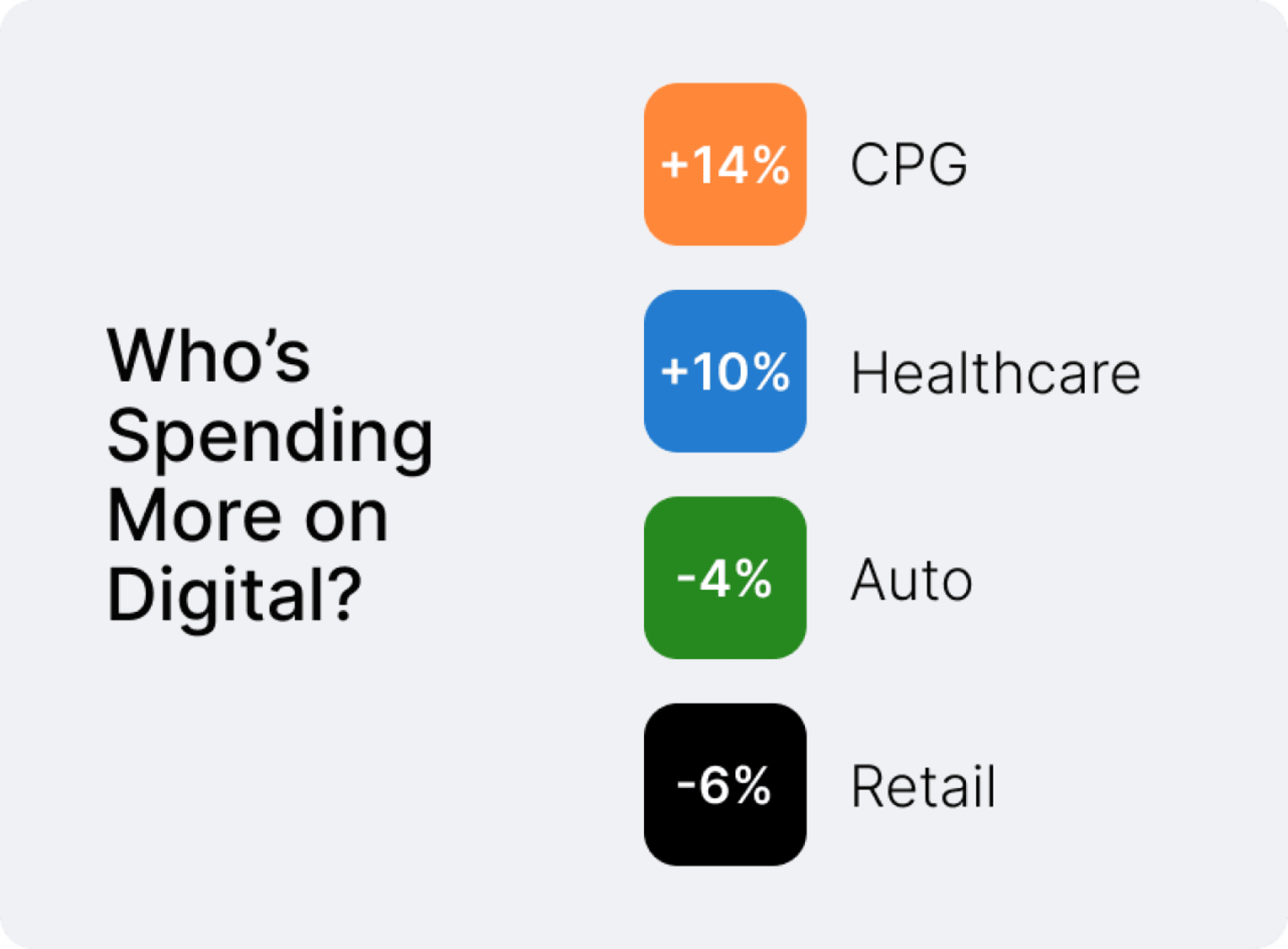

Not all sectors are following the same path. Data from AWISEE shows:

- Consumer packaged goods and healthcare have seen strong digital growth, with budgets rising 14% and 10%, respectively.

- Automotive and retail brands are tightening spend, with reductions of about 4% and 6%, respectively.

- B2C service companies are allocating a higher share of their budgets to marketing compared to product-based companies, reflecting a greater emphasis on customer experience and acquisition.

Moonfruit

Platform Dominance and Agency Disruption

In the current landscape, a handful of companies are absorbing a majority of digital ad spend. Meta and Google each reported bigger-than-expected ad revenues earlier in the year, reflecting their dominance in performance and targeting. Meanwhile, TikTok and Amazon are aggressively expanding their ad tools, appealing to advertisers eager for more integrated commerce options.

At the same time, traditional ad agencies are feeling the pressure. WPP, one of the world's largest agency holding companies, lowered its revenue outlook and accelerated AI investments in response to client demand for faster, data-led solutions.

Consumer Implications: What It Means at Birds-Eye Level

This realignment is changing the consumer experience in subtle but important ways:

- Ads are becoming more personalized and embedded, surfacing during shopping, video streaming, or even smart assistant interactions.

- As advertisers rely more on first-party data, contextual targeting is replacing invasive tracking, signaling a shift toward more privacy-conscious advertising strategies.

- Consumers may notice fewer traditional ads and more interactive, dynamic formats aligned with their behaviors and

Connecting to Broader Trends

The changes unfolding in 2025 are part of larger movements in technology, economics, and media:

- Tariffs, deglobalization, and broader macroeconomic shifts are prompting brands to spend more cautiously while focusing on operational efficiency.

- Ad spend is increasingly controlled by a few large platforms that offer end‑to‑end campaign tools, funding development of in‑house AI and further sidelining agencies.

- Calls from marketers for transparent, accountable attribution tools are gaining momentum. Gone are blanket brand safety bans, as some agencies believe they're over‑blocking ads on reputable news sites.

What Comes Next?

As the second half of the year unfolds, more brands are expected to expand AI testing across their campaign workflows, deepening their reliance on automation and generative tools. At the same time, investment in commerce-driven advertising continues to rise, as marketers prioritize channels that bring consumers closer to conversion. Many companies are also reassessing their agency relationships, shifting toward in-house capabilities or partnering directly with platforms to gain more control and efficiency.

These aren’t just marketing trends — they’re indicators of how digital media is evolving in real time. The platforms, tools, and tactics brands invest in today will shape how people experience the internet tomorrow.

This story was produced by Moonfruit and reviewed and distributed by Stacker.